Should You Buy or Sell a 30A Home in Today's Economy?

What the Data, History, and Current Market Trends Really Say

If you're feeling hesitant about buying or selling real estate on 30A right now, you're not alone. Many buyers and sellers are weighing their options carefully as headlines warn of rising tariffs, stock market volatility, and the looming possibility of a recession.

But here's the thing: uncertainty doesn't always mean it's time to hit pause. In fact, history and current housing trends tell a different story — and one that may surprise you.

As your trusted 30A real estate advisor, I’m not here to push you toward a decision. My role is to offer you real insights and historical context — so you can feel equipped to move forward with clarity and confidence.

Let’s take a look at what’s really happening in today’s market, what history tells us about housing in times of economic uncertainty, and what it all means for you — whether you’re looking to buy, sell, invest, or simply stay informed.

A Closer Look at National Housing Trends: The Market Is Cooling, Not Crashing

We’re in a very different housing environment than we were just a few years ago. And that’s not a bad thing.

According to data from Keeping Current Matters, here are three key trends happening nationally between February 2024 and February 2025 — and what they mean for you.

1. Housing Inventory Is Increasing — and 30A Is Leading the Trend

Nationally, housing inventory is up 27.5% year over year. In raw numbers, that’s an increase from 664,745 homes available in February 2024 to 847,825 in February 2025. For buyers, this means more choice, less competition, and the ability to take their time rather than rush into bidding wars. For sellers, it signals the need for smarter pricing, stronger marketing, and more patience.

But here on 30A, we’re seeing an even more pronounced inventory surge — and it’s creating a very interesting dynamic.

Yes, it’s technically a buyer’s market in terms of inventory and days on market. But unlike what we’re seeing in many other parts of the country, we’re not seeing significant price reductions or panic selling.

In fact, quite the opposite:

The average sale price on 30A increased by over 6% from Q1 2024 to Q1 2025.

List-to-sale price ratios are holding above 90%, which means while there’s room for negotiation, sellers aren’t slashing prices — and they aren’t having to.

The inventory may be higher, but the quality and uniqueness of many 30A properties means demand is still active, especially for newer homes, well-positioned rental properties, and those in high-demand communities.

If you’re a buyer, you have more options than you’ve had in recent years — and you likely won’t be competing with multiple offers. That gives you space to breathe, negotiate, and make a thoughtful decision. But don’t mistake high inventory for a crash scenario. If you’re expecting dramatic price cuts, you may miss the window altogether while waiting on something that never comes.

If you’re a seller, you can still command strong prices — but you need to be realistic. Buyers expect some flexibility in this market, and overpricing or under-preparing your home can lead to extended days on market. Homes that are turnkey, priced appropriately, and marketed with intention are still moving — and moving well.

The bottom line: this is a rare moment of opportunity on both sides of the transaction, but it requires strategy, not speculation.

2. Home Prices Are Still Rising — But More Slowly

The national median sales price of existing homes increased from $383,800 to $398,400, which is a 3.8% rise. This stat is crucial: Prices aren’t dropping. They’re normalizing. That 3.8% appreciation is more in line with historical norms than the 10–20% annual jumps we saw during the frenzy of 2021–2022.

As mentioned above, home prices on 30A are outperforming the national average, which is the trend we've seen due to the strength of our market.

This is good news for both sides of the transaction.

Sellers can still earn a solid return on their property, particularly if they’ve owned for 3+ years.

Buyers are no longer facing unsustainable price inflation, but they also don’t need to fear a market crash.

In other words, if you’re waiting for a “bottom” to buy in — you might be waiting for a long time.

In the 30A market specifically, prices are mostly holding steady due to continued demand for luxury vacation homes and the opportunity to own in one of the most coveted beach communities in the country. The most desirable homes — beachfront, south of 30A, turnkey rental machines — are still commanding strong prices and quick interest.

3. Homes Are Sitting on the Market Longer

The national average days on market rose from 61 to 66 — an 8.2% increase. This may not sound like a major shift, but in real estate, it’s meaningful. Buyers are being more patient. They’re taking time to compare options, run the numbers, and ensure they’re making the right decision. Here on 30A, the average is 126 Days on Market, which is substantial.

For buyers, this means less pressure and more breathing room. The days of writing an offer in the driveway are largely behind us — for now.

For sellers, it’s a reminder that strategy matters. You can still sell successfully, but overpricing or under-marketing your property will cost you time and money

What History Tells Us: Recessions Don’t Equal Housing Crashes

A lot of people are haunted by the memory of 2008. But it’s important to understand that the Great Recession was a housing crisis, not just an economic downturn. The two are not the same.

Looking at the last six U.S. recessions:

Home prices actually increased in 5 of the 6.

The only significant drop occurred in 2008, when prices fell by nearly 20% due to a housing bubble and subprime lending collapse.

In all other cases (1980, 1981, 1991, 2001, 2020), home prices remained stable or grew modestly.

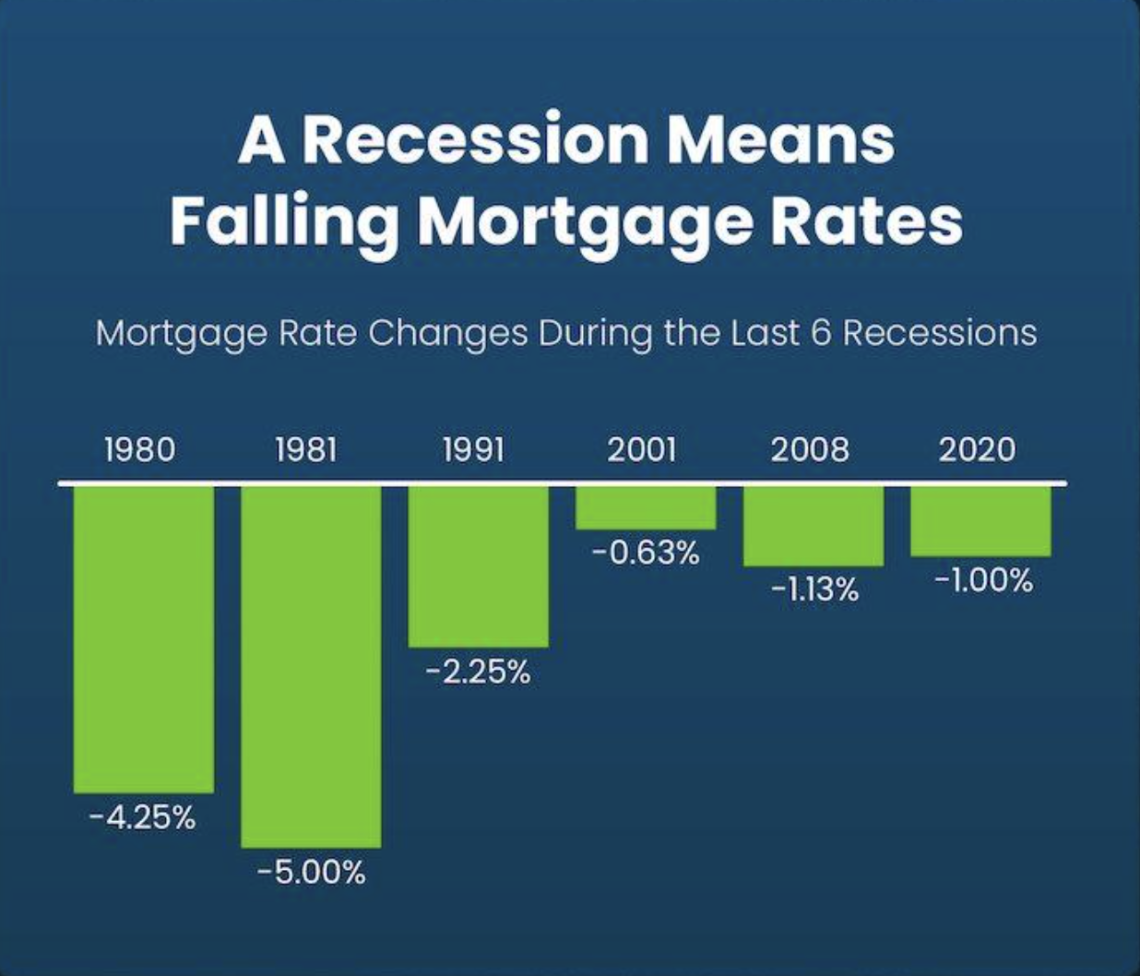

Mortgage Rates Tend to Fall During Recessions

Across the same six recessions, mortgage rates dropped every single time — often significantly. This is why some buyers are choosing to purchase now — even at today’s higher rates. They know they can refinance later if and when rates come down again. In fact, I've had conversations with my preferred lenders recently where a 7-year ARM on a Jumbo loan product is as low as 5.5%. There could be options available to you should you be ready to make a move.

If you’re in a position to buy today, it’s worth considering that the perfect storm of lower prices and lower rates is rare. Often, as soon as rates drop, buyer demand skyrockets — and prices go back up fast.

So… Should You Wait or Should You Make a Move?

If You’re Thinking About Buying

Now may be the perfect time if:

You’ve found the right home.

You’re financially stable and not overextending.

You’re planning for long-term enjoyment or income.

With more listings and less competition, you have negotiating power — something that was nearly impossible in 2021. But don’t mistake today’s higher interest rates as a reason to wait forever. The best deals are often found in the moments of hesitation, not hype.

If You’re Thinking About Selling

You can still win — but you’ll need a game plan. Your home has likely appreciated in value over the last few years. But buyers are more selective now. Homes that are:

Priced accurately,

Presented beautifully,

Marketed creatively, ... are still selling fast.

If you’re unsure whether now is the right time, consider a soft launch strategy. We can quietly test the waters with private showings, off-market marketing, or "coming soon" exposure.

If You’re a Homeowner Keeping an Eye on Things

It’s smart to stay informed, even if you’re not making a move today.

You might consider:

Getting a current market valuation. You can request one HERE!

Making value-adding updates in preparation for a future sale.

Talking through what a refinance or cash-out scenario could look like.

Final Thoughts: What the Right Move Looks Like for You

Real estate is not one-size-fits-all. Your next step should reflect your goals, your timeline, and your comfort level — not someone else’s urgency or the daily news cycle.

If you’re feeling unsure, here’s what I’d encourage you to do:

Take a breath. Get educated. Talk to someone who knows both the national data and the local dynamics. Then make a decision that feels right for you.

Whether that means buying, selling, or waiting — I’m here to help you do it wisely.

Ready to Talk?

Let’s have a real conversation about what’s best for you right now.

Schedule a 1-on-1 call with me. I’m here to help — no pressure, no sales pitch, just support.

This is your journey. I’m just here to guide you toward the achievement of your beach dreams.

Get Your Questions Answered!

Schedule a Call Today.

We're here to offer guidance and expertise leading you to achieving your goals on 30A!