30A Real Estate Market: 2024 Year in Review and Predictions for 2025

The 2024 housing market on 30A demonstrated resilience amid shifting conditions. Rising mortgage rates, higher inventory, and heightened buyer selectivity characterized the year, leaving both buyers and sellers adjusting their strategies. As we step into 2025, understanding the market dynamics of the past year will help guide future decisions. Whether you’re buying or selling, this article will break down key 2024 trends and offer insights into what’s ahead.

2024 Market Highlights

Single-Family Homes

In 2024, single-family home sales experienced a noticeable dip compared to the previous year. A total of 945 single-family homes were sold, down 8.25% from 2023, reflecting the challenges posed by higher mortgage rates and cautious buyer behavior. Despite this decline in sales, the market saw a remarkable increase in average sold prices, which rose by 6.4% to $2.36 million. This suggests that demand for premium properties, especially those in coveted locations like south of 30A, remained strong.

Interestingly, while prices climbed, the average price per square foot dropped slightly by 0.76% to $781. This discrepancy could indicate a trend toward larger properties being sold, with buyers prioritizing space over cost efficiency. The days on market (DOM) metric also revealed slower market activity, with homes taking 40.6% longer to sell, averaging 97 days compared to 69 in 2023. The most significant sale of the year was a beachfront estate that fetched $28.5 million, underscoring the ongoing appeal of ultra-luxury properties on 30A.

While the number of homes sold declined, inventory levels tell a different story. The first week of January 2025 saw a 24.5% increase in active listings compared to the same time in 2024, reflecting higher inventory in the market. This shift gives buyers more options but also highlights longer selling times.

Condos

The condo market faced even steeper challenges in 2024, with sales dropping 19.7% to 220 units. However, pricing remained relatively stable, with the average sold price decreasing by only 1.88% to $1.51 million. Interestingly, the price per square foot for condos edged up by 0.77%, reaching $1,048. This indicates that while fewer units were sold, the value per square foot remained strong, particularly for high-end condos. The DOM for condos increased by 21.1%, with units averaging 92 days on the market. The top condo sale of the year was a luxurious Alys Beach Gulf-front property that sold for $7.98 million, reflecting the continued demand for premium locations.

Mortgage Rates

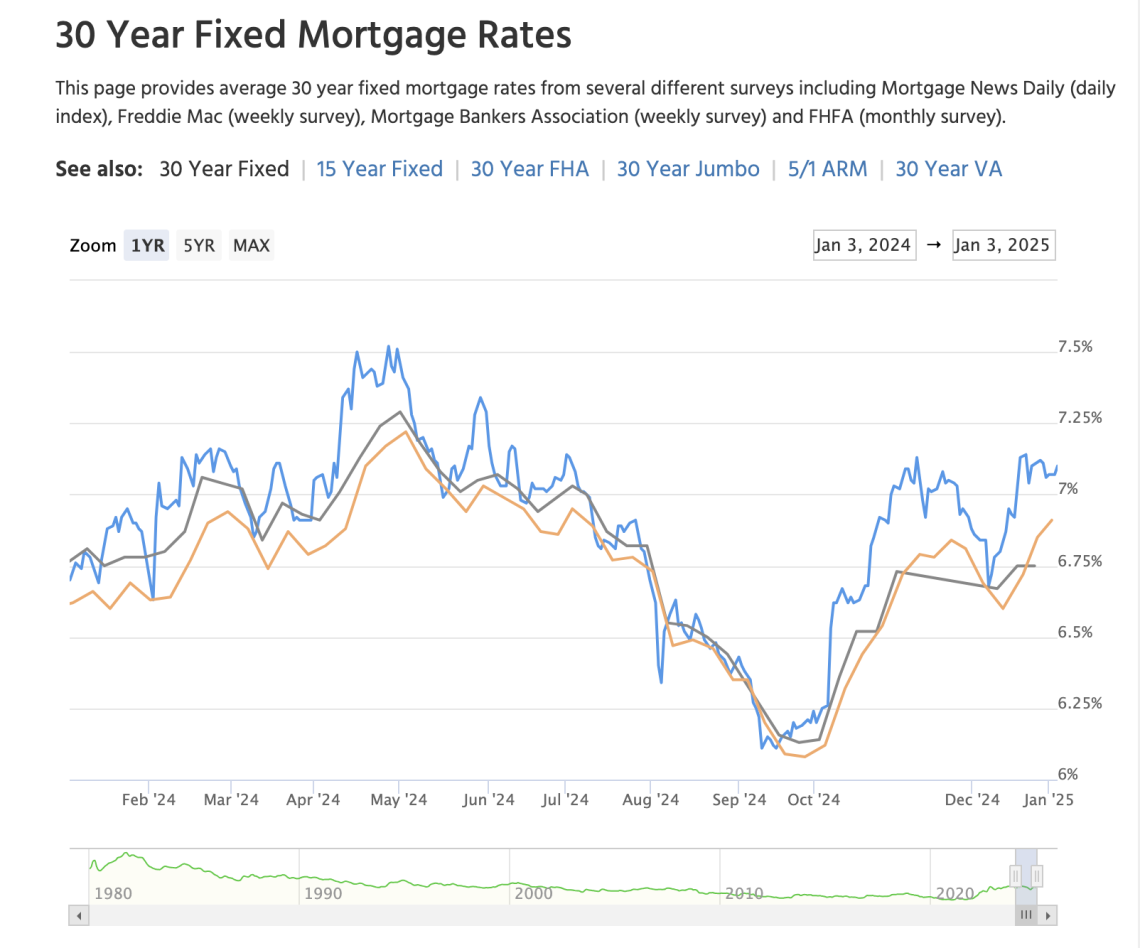

Mortgage rates played a significant role in shaping the 2024 market. Rates for a 30-year fixed mortgage ranged from 6.14% to 7.4%, presenting affordability challenges for buyers relying on financing. The 15-year fixed rate averaged between 5.63% and 6.85%, while jumbo loans hovered between 6.38% and 7.67%. These higher rates contributed to slower sales activity but also encouraged buyers to lock in rates quickly when favorable conditions arose.

It’s important to note that buyers were hindered by these higher rates, with many postponing purchases in hopes of future rate drops. However, as we’ve seen over the past two years, rates have remained relatively consistent and are unlikely to return to the historically low 3%-4% range. Buyers who continue to wait may face higher prices in the future as homes on 30A appreciate in value, potentially costing more for the same property down the line.

Predictions for 2025

As we look ahead to 2025, market experts forecast modest price increases, greater inventory, and a potential rebound in sales activity. Here’s what buyers and sellers can expect:

For Buyers: Opportunities and Strategies

More Choices, Less Competition

Inventory levels are expected to rise again in 2025, offering buyers more options than in recent years. In 2024, the number of active listings grew by 24.5% year over year, and this trend is likely to continue. With more properties on the market, buyers can take their time to evaluate options and negotiate better terms.

Strategic Financing

Mortgage rates are predicted to stabilize around 6%, but the possibility of rate volatility remains. Buyers should stay pre-approved and work closely with lenders to secure the best rates. Timing will be crucial, as even slight rate dips could mean significant savings over the life of a loan.

Investment Potential

With 30A’s thriving tourism industry, vacation rentals remain a good investment that can help offset cost of ownership in part or in its entirety. Premium properties, particularly those south of 30A, could generate rental incomes exceeding $100k annually. Buyers interested in rental properties should prioritize homes with desirable amenities and proximity to popular attractions.

For Sellers: Staying Competitive

Price It Right

Competition among sellers is expected to intensify with increasing inventory. Sellers must be strategic with pricing to attract buyer interest and avoid prolonged time on the market. Competitive pricing remains one of the most effective ways to secure a timely sale.

Prepare to Impress

In a more balanced market, presentation matters. Homes that are professionally staged and marketed with high-quality visuals stand out, attracting serious buyers. Sellers should focus on highlighting unique features and ensuring their property is in top condition.

Capitalize on Demand for Premium Properties

Properties south of 30A will likely remain highly sought after in 2025. Sellers in these areas should emphasize benefits like beach access, luxury finishes, and proximity to dining and shopping.

It’s also important to recognize that many sellers on 30A are not in "must sell" situations. This allows them to hold onto their homes rather than offering steep discounts to close a deal. As a result, buyers shouldn’t expect significant markdowns, even in a higher inventory market.

2025 Market Wild Cards

Several factors could shift the market dynamics unexpectedly. Here are some potential wild cards to watch:

1. Mortgage Rate Fluctuations

If rates climb higher than anticipated, affordability could decrease, leading to slower sales. Conversely, a drop in rates could bring more buyers into the market, boosting competition.

2. Economic Trends

A strong economy could bolster buyer confidence, while a downturn might prompt more conservative spending. Global events and local economic shifts will play a role in shaping the market’s trajectory.

3. New Housing Policies

Changes in federal or state housing policies, such as incentives for new construction or regulations affecting supply chains, could impact inventory levels and pricing.

Your Next Steps

Whether you’re buying or selling on 30A in 2025, preparation and strategy will be key. Buyers should stay flexible and ready to act quickly when favorable opportunities arise. Sellers, on the other hand, need to focus on pricing, presentation, and marketing to stay competitive in a crowded market. If you’re ready to make a move or simply want to explore your options, let’s connect. I’m here to help you navigate the 30A market with confidence and achieve your real estate goals.

Making a Move in 2025?

Get in touch. We're here to offer guidance and expertise leading you to achieving your goals on 30A!