2025 30A Real Estate Market: Trends, Wild Cards, and What Buyers & Sellers Need to Know

The 2025 housing market on 30A is shaping up to be an exciting one. While forecasts predict steady growth, increased inventory, and more opportunities for buyers, there are still several wild cards that could shake things up.

From unexpected mortgage rate swings to potential changes in housing policies, a variety of factors could impact your ability to buy or sell a property on 30A this year. Here’s a breakdown of what the experts predict for 2025 — and the potential curveballs that could shift the market in unexpected ways. Below you'll find everything you need to understand what could be ahead for us in 2025 including graphs and data from industry leaders showing their predictions about what could be ahead for us. Enjoy!

The Big Picture: Expert Forecasts for 2025

Before diving into the wild cards, let's start with the key trends expected to shape the 30A real estate market. From home prices to mortgage rates, these are the forces at play for buyers and sellers.

1. Home Prices: Modest Increases Ahead

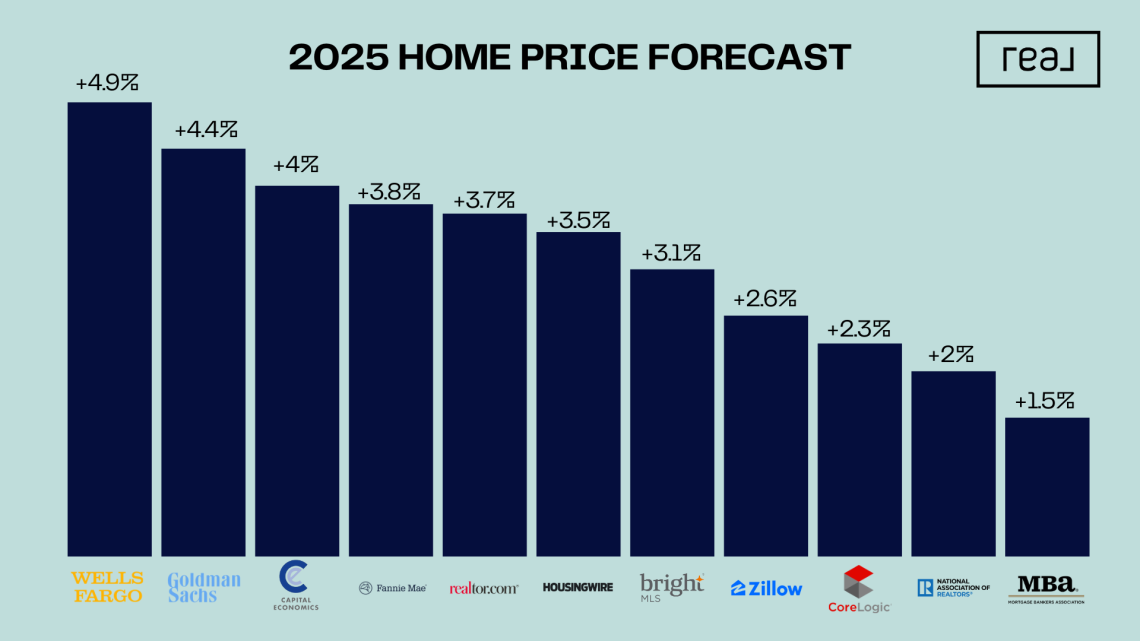

Economists predict home prices will see modest growth in 2025, with an expected increase of 2% to 5% nationwide. For 30A, where demand for vacation and second homes remains strong, this could be on the higher end of the range.

If you’re a homeowner on 30A, this is great news. It means your home equity will continue to grow, albeit at a more measured pace compared to the double-digit surges of recent years. Buyers, meanwhile, will benefit from a market that isn’t running away from them like it did during the pandemic housing boom.

What It Means for You:

- Buyers: The gradual rise in home prices means you won’t be priced out of the market overnight. Act sooner rather than later to secure a property before prices climb further.

- Sellers: Price your home competitively to capture buyer interest. While the market is still strong, strategic pricing can help you sell faster.

2. Home Sales: A Return to Healthy Activity

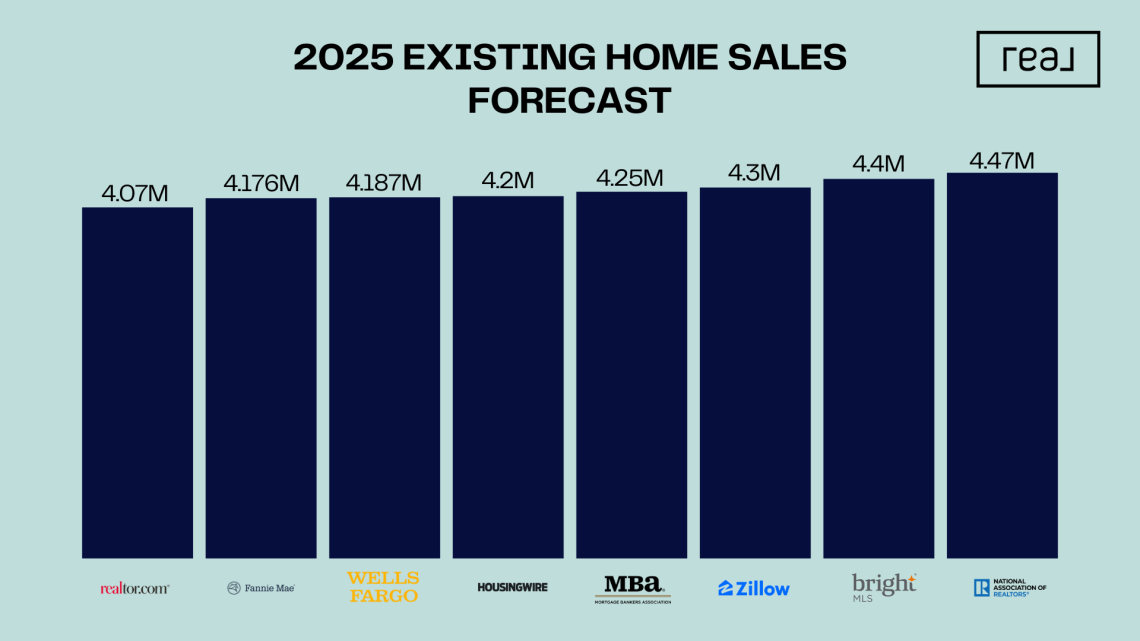

After slower home sales in 2023 and 2024, experts predict a rebound in 2025. While higher mortgage rates have kept some buyers on the sidelines, the pent-up demand for vacation homes and investment properties on 30A is expected to reignite.

More sales mean more movement — and for those waiting for the "right time" to buy or sell, 2025 might be it.

What It Means for You:

- Buyers: Competition could increase, so be prepared to act quickly when you see the right property.

- Sellers: More sales activity means more buyers entering the market, but keep in mind that increased inventory (see below) could impact how quickly your property sells.

3. Inventory: Buyers Finally Get More Options

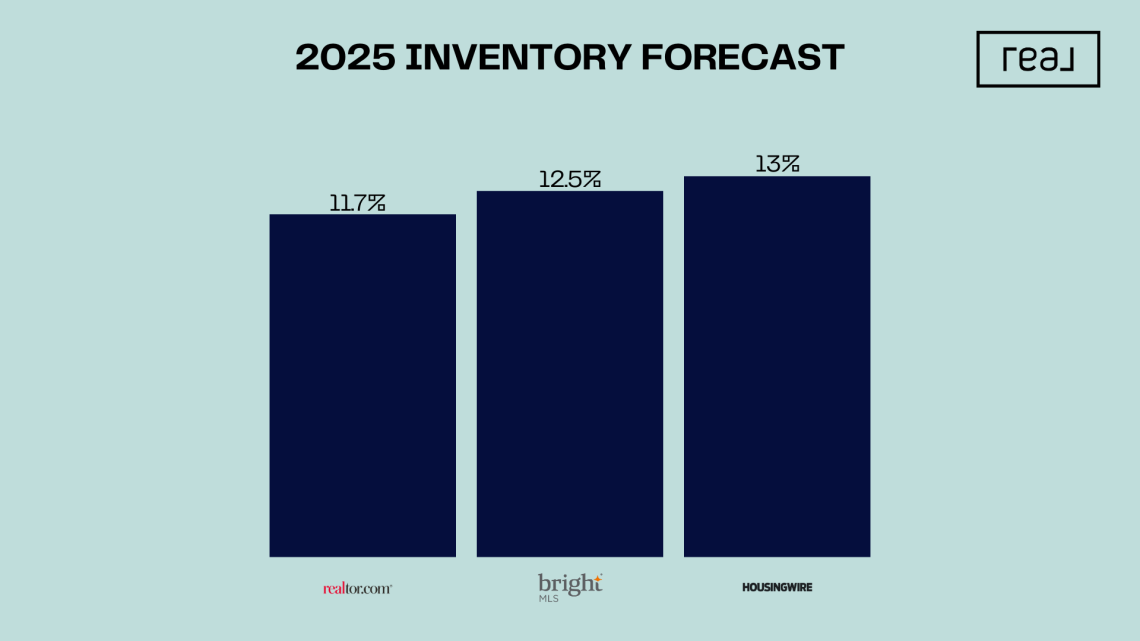

For the past several years, on a national level, the lack of available homes has been a major challenge. But in 2025, that’s set to change. Industry analysts expect inventory to increase nationwide by double digits. For 30A, we've already seen higher inventory numbers over the past year. The national change will certainly trickle down to our market and could mean more condos, single-family homes, and vacation properties hitting the market.

However, don’t expect it to be a free-for-all. While buyers will have more options, 30A remains a highly desirable market, and prime properties — especially homes south of 30A — will continue to move quickly if priced correctly.

What It Means for You:

- Buyers: You’ll have more choices and more negotiating power. While you won’t be able to wait forever, you’ll likely face fewer bidding wars.

- Sellers: If more homes come on the market, your competition increases. Focus on making your property stand out with top-notch marketing, staging, and competitive pricing.

4. Mortgage Rates: The Ultimate Wild Card

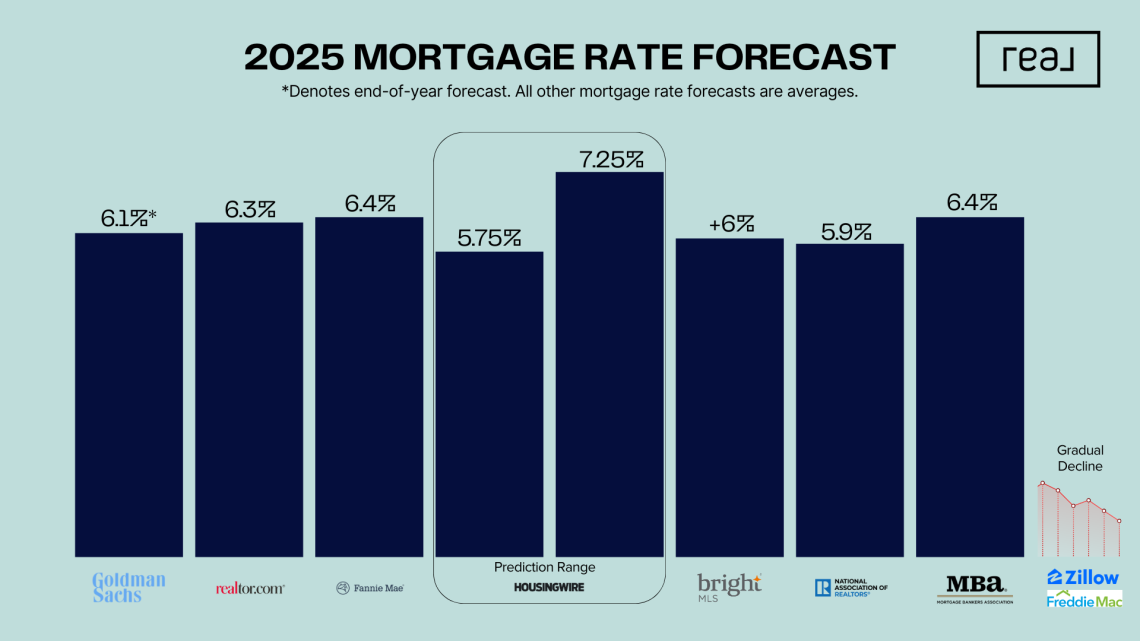

If there’s one thing that could derail the 2025 housing market, it’s mortgage rates. While most experts predict rates to stabilize around 6%, unexpected shifts in inflation, Federal Reserve policies, or global events could cause volatility.

This has a direct impact on the 30A market. Since many buyers purchase second homes or investment properties with financing, higher mortgage rates could reduce purchasing power and lower demand for higher-priced homes.

What It Means for You:

- Buyers: Stay flexible. If you see rates dip, lock in quickly. Being prepared with pre-approval can help you move fast.

- Sellers: Higher rates could limit what buyers are willing (or able) to pay, so make sure your home is priced smartly from the start.

The Wild Cards That Could Shake Up the 2025 30A Market

Forecasts are one thing — but wild cards are another. These unpredictable factors have the potential to shift everything. Here are the ones to watch.

1. Mortgage Rate Surprises

If mortgage rates climb higher than expected, it could impact affordability for buyers. Inflation, Federal Reserve policy changes, or geopolitical issues could all play a role in rate volatility.

What It Means for You:

- Buyers: Plan to be nimble. Rates could shift at any time, so when they dip, be ready to lock in.

- Sellers: If buyer budgets shrink, you may need to reconsider your list price. A well-priced home will still sell, even in a rate-sensitive market.

2. Changes to Federal Housing Policies

New housing policies at the federal level could have ripple effects on the 30A real estate market. If lawmakers pass initiatives to boost housing supply, it could increase inventory, while higher construction costs from tariffs or regulations could slow development.

What It Means for You:

- Buyers: More supply could bring better deals, but rising construction costs could keep prices high.

- Sellers: If new developments increase inventory, you may face more competition. Consider listing sooner rather than later to avoid future competition.

3. Economic Shifts or Recession Risks

Economic downturns or recessions can cool the housing market as buyers pull back. While current forecasts don't predict a major recession, unexpected global events could have ripple effects.

What It Means for You:

- Buyers: A slower economy could mean less competition, but financing could become tougher.

- Sellers: Be prepared for longer selling times. Homes priced properly will still sell, but patience may be required.

How to Stay Ahead of the Wild Cards

Navigating the 2025 housing market on 30A will require flexibility, patience, and preparation. Buyers should stay ready to act when the right property becomes available — especially if mortgage rates dip. Sellers should prioritize pricing, presentation, and marketing to make their property stand out.

If you’re thinking about buying or selling on 30A in 2025, I’d love to be your guide. From navigating mortgage rates to finding off-market deals, I’m here to help you make confident moves in a changing market.

Let’s Connect — Contact me today to discuss your 30A real estate goals for 2025. Whether you’re looking for a dream vacation home or ready to sell at the peak of the market, I’ll help you make the most of every opportunity.

Schedule a call below or Email Me: [email protected]

Ready to Build Your Plan for 2025?

Schedule a strategy call below. My team is ready to help you succeed!